Marla Gottschalk | | | | | | | | | EXECUTIVE OFFICERS | | | | | | $ | 67,500 | | | $ | 83,704 | | | $ | 151,204 | | David Head | | $ | — | | | $ | 136,792 | | | $ | 136,792 | | David Near | | $ | 7,562 | | | $ | 146,559 | | | $ | 154,121 | | Benjamin Rosenzweig | | $ | — | | | $ | 147,560 | | | $ | 147,560 | | Todd Smith | | $ | 7,562 | | | $ | 146,559 | | | $ | 154,121 | |

| (1) | EXECUTIVE OFFICERS

Below is a list of the names, ages as of December 25, 2016, positions, and a brief account of the business experience, of the individuals who serve asPursuant to our executive officers.

| | | | | | | Name | | Age | | | Position | Aylwin Lewis

| | | 62 | | | Chairman, Chief Executive Officer and President | Michael Coyne

| | | 53 | | | Senior Vice President and Chief Financial Officer | Julie Younglove-Webb

| | | 46 | | | Senior Vice President, Operations | Matthew Revord

| | | 53 | | | Senior Vice President, Chief Legal Officer, General Counsel and Secretary | Nancy Turk

| | | 52 | | | Senior Vice President, Chief People Officer and Corporate Communications | Anne Ewing

| | | 52 | | | Senior Vice President, Development | Sherry Ostrowski

| | | 47 | | | Senior Vice President, Brand and Sales Development |

Aylwin Lewis has served as our Chief Executive Officer and President and a director since June 2008. From September 2005 to February 2008, Mr. Lewis served as Chief Executive Officer and President of Sears Holdings Corporation. Prior to that, Mr. Lewis was President of Sears Holdings and Chief Executive Officer of KMart and Sears Retail following Sears’ acquisition of KMart Holding Corporationcompensation program in 2005. Mr. Lewis had been president and Chief Executive Officer of KMart since October 2004 until that acquisition. From January 2003 to October 2004, he was President, Chief Multi-Branding and Operating Officer of Yum! Brands, Inc. and served as Chief Operating Officer of Yum! Brands from December 1999 to January 2003. Mr. Lewis has nearly 30 years of experience in the restaurant industry. Mr. Lewis is also a member of the board ofeffect for 2020 described above under “Director Compensation Plan,” all non-employee directors of The Walt Disney Company and Marriott International, Inc.

Michael Coyne has been our Senior Vice President and Chief Financial Officer since May 2015. Prior to joining Potbelly, Mr. Coyne was at CNA Financial from 2005 until 2015, most recently as Senior Vice President, Small Business and prior to that as divisional Chief Financial Officer of CNA’s Property & Casualty Operations business. Prior to CNA, Mr. Coyne spent seven years at Sears Holding Company, culminating as Vice President and Treasurer.

Julie Younglove-Webb has been our Senior Vice President of Operations since May 2015. Ms. Younglove-Webb joined Potbelly in 2008, first learning operations as a General Manager, then serving as a District Manager before assuming various operations roles before being promoted to Central Zone Vice President. Prior to joining Potbelly, Ms. Younglove-Webb was Senior Vice President and General Manager of Sears Essentials at Sears Holding Corporation, a role she assumed in 2005 after Sears’ acquisition of KMart Holding Corporation. Prior to that acquisition, Ms. Younglove-Webb held various roles of increasing responsibility beginning when she joined KMart in 1999 as Manager, Information Technology and culminating with her role as Vice President, Marketing.

Matthew Revordhas been our Senior Vice President, Chief Legal Officer, General Counsel and Secretary since February 2014 and oversees all legal mattersreceived RSUs of the Company having a value of $75,000 at the time of grant plus an annual retainer of $60,000 payable in cash or RSUs at the option of the director. Mr. Boehm received an additional $7,500 retainer for his role as Chair of the Nominating and international development. Mr. Revord joined PotbellyCorporate Governance Committee, in January 2007 as our Senior Vice President, General Counsel and Secretary. From January 2002 to January 2007, Mr. Revordthe form of RSUs. Ms. Gottschalk served as Deputy General CounselAudit Committee Chair and received an additional $15,000 retainer, in the form of Brunswick Corporation50% cash and General Counsel of Brunswick New Technologies.

Nancy Turkhas been our Senior Vice President, Chief People Officer and Corporate Communications since February 2014. Ms. Turk joined Potbelly in July 2008 as our Senior Vice President, Human Resources and Corporation Communications. From 2005 to July 2008, Ms. Turk50% RSUs. Mr. Rosenzweig served as Compensation Committee Chair and received an additional $10,000 retainer, in the Divisional Vice Presidentform of Corporate Communications at Sears Holdings, and held various human resources leadership roles at Sears Holdings since 1993, where she was involved in divestitures, mergers and acquisitions with Sears Credit, Lands’ End and KMart.

Anne Ewing has been our Senior Vice President, Development since October 2013.RSUs. Ms. Ewing joined Potbelly in March 2007 and has held various leadership positions in Operations and Marketing. In November 2012, Ms. Ewing was promoted to VP, Development. Prior to joining Potbelly, Ms. Ewing spent 13 years with Starbucks in various leadership positions including Vice President of Operations for the Northeast and Vice President of New Store Development for the Midwest.

Sherry Ostrowski has been our Senior Vice President, Brand and Sales Development since March 2016. Ms. Ostrowski joined Potbelly in November 2012 as Vice President of Marketing. She is responsible for all marketing activities, including brand marketing, menu innovation, calendar development, digital & social media and consumer insights. Prior to joining Potbelly, Ms. Ostrowski was at Taco Bell from 2000 through 2012, where she held various roles culminating with her position as Sr. Director, Marketing (Brand Execution, Field Marketing &Non-Traditional Channels). She worked on the advertising agency-side of the business prior to 2000.

| | | | | | | | | | | | | | | EXECUTIVE AND DIRECTOR COMPENSATION |

EXECUTIVE AND DIRECTOR COMPENSATION

Introduction

Our compensation philosophy is to pay for performance, rewarding employees when performance targets are met. Merit increases, annual incentive compensation, equity awards, and incremental paid time off are all tied to performance and results. Our compensation programs are designed to attract, retain, motivate, and reward employees. Pay is commensurate with the scope and influence of the employee’s role and the extent to which an employee contributes to the achievement of key initiatives and financial targets, and demonstrates our values. All of our compensation programs are designed to align and reward actions that we believe contribute to our competitiveness and encourage superior performance.

For 2013, in preparation for our IPO, management engaged compensation consultants, Aon Hewitt, to conduct an analysis of our compensation programs and provide recommendations for how best the executive pay programs could be designed after our IPO. In addition to providing advice about broad-based plans generally available to all salaried employees, Aon Hewitt provided:

1. | Executive benchmarking analysis comparing our executives base salary, target variable pay, and total cash compensation (base salary and target variable pay) to market. The compensation consultants also provided details onpost-IPO competitive market levels of equity compensation; and |

2. | Review of executive employment agreements for competitiveness and compliance with institutional shareholder advisor and general market governance requirements. Aon Hewitt also provided recommendations regarding the competitiveness of the employment agreements against similarly situated companies. |

The compensation committee considered Aon Hewitt’s recommendations as well as relevant market practices when setting executive compensation to align our executive compensation program with the market for which we compete for executive talent. Our market for executive recruiting is generally other restaurant or retail concepts. Fornon-operations executives, we look at the general restaurant industry. In evaluating the competitiveness of our executive compensation program, we target compensation against the restaurant industry, specifically the limited-service restaurant segment, and national and local competitors to help ensure we are competitive, focusing on items such as equity awards, merit pay, incentive pay and paid time off. We evaluate our executives on a scale of one through five. A score of three means the executive is a “Contributor,” four is a “High Contributor” and five is a “Star.” Annual cash compensation varies based on the executive’s score, other individual performance measures, Company performance, and contributions to Potbelly.

Executive pay is tied to both the Company’s and the individual’s annual performance. Merit increases, annual incentive compensation, stock options, when granted, and paid time off are generally awarded in March or April of each year, following completion of the first quarter annual performance review cycle, the annual financial audit and approvalChapman-Hughes resigned from the compensation committee. The employment agreementsBoard of our named executive officers specify each executive’s annual incentive bonus target under our current bonus program. In addition, atDirectors on June 8, 2020 and Mr. Ginsberg resigned from the discretionBoard of the compensation committee in the case of our Chief Executive Officer,Directors on June 9, 2020. Messrs. Near and at the discretion of our Chief Executive Officer and upon the approval of the compensation committee in the case of our other executive officers, there may be an increase or decrease applied to the annual bonus awarded to an executive, including the other named executive officers, in order to account for exceptional circumstances. However, it is anticipated that such bonuses would only be awarded under unusual circumstances to further the objectives of our compensation program. For example, the named executive officers received a discretionary cash bonus for the performance in fiscal year 2016. See“–Non-Equity Incentive Awards–2016 Discretionary Bonus” below.

In 2015, the compensation committee engaged Aon Hewitt to conduct an analysis of and provide recommendations for our director compensation programs. The compensation committee considered the benchmarking analysis provided by Aon Hewitt as well as market practice when forming their recommendationSmith were appointed to the Board of Directors concerning appropriate compensation foron May 10, 2020.

|

| (2) | Ms. Susan Chapman-Hughes and Mr. Ginsberg served as members of our Board of Directors. Directors for part of 2020, and received compensation in the fourth quarter of 2019 for such service. |

| (3) | Messrs. Boehm, Head, Near, Rosenzweig and Smith chose to take all or a portion of their annual cash retainers in the form of RSUs. |

| (4) | The compensation committee also engaged Aon Hewittfollowing directors have unvested stock awards at December 27, 2020: Mr. Boehm – 63,366; Mr. Butler – 26,545; Ms. Gottschalk – 29,199; Mr. Head – 39,528; Mr. Near – 35,146; Mr. Rosenzweig – 35,285; and Mr. Smith – 35,146; each of which represents the RSU awards made by the Company in 2015 to conduct a competitive analysis2020, as discussed in footnote (1) above, and in 2019. Ms. Gottschalk had 51,614 unexercised options at December 27, 2020. |

Director Stock Ownership Guidelines The Board believes that all directors should hold a significant equity interest in Potbelly. Toward this end, the Board expects that all directors own, or acquire within five years of first becoming a director, shares of Potbelly common stock (including restricted shares, but not options, under Potbelly’s equity-linked incentive plans) having a market value of at least four times the annual cash compensation for directors (excluding any additional retainer received for service as Chairman of the Board or Lead Director, or as Chair of any Board committee) offered to directors (regardless of whether the director elects to receive such compensation in cash or equity). PROPOSAL 1 Election of Directors Nine candidates will be elected at the Annual Meeting to serve for a one-year term that will expire at the 2022 Annual Meeting and until their successors shall have been elected and qualified. The election of directors requires the affirmative vote of a plurality of our shares of common stock present in person or by proxy at the Annual Meeting. Our Board of Directors has nominated Vann Avedisian, Joseph Boehm, Adrian Butler, Marla Gottschalk, David Head, David Near, Benjamin Rosenzweig, Todd Smith and Robert D. Wright for election as directors. The Board of Directors is not aware that any nominee will be unwilling or unable to serve as a director. All nominees have consented to be named in this Proxy Statement and to serve as a director of the Company if elected. Proxies may not be voted for a greater number of persons than the number of nominees named in this Proxy Statement. In the Board’s view, the Board’s nominees possess the requisite experience and skills to successfully oversee the Company’s strategy and business. The Board, and its nominees, are dedicated to analyzing objectively the Company’s strategy, business operations, capital allocation and configuration and acting to maximize stockholder value. For more information on the structure of our Board of Directors and our Board members and nominees, see “Corporate Governance.” The qualifications and experience of each nominee that led our Board and the Nominating and Corporate Governance Committee to conclude that such nominee should serve or continue to serve as director are discussed at the end of each of the nominees’ biographies. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THESE NOMINEES. PROPOSAL 2 Ratification of Appointment of Independent Registered Public Accounting Firm The Audit Committee of our Board of Directors is responsible for recommending, for stockholder approval, our independent registered public accounting firm. The Audit Committee has selected the accounting firm of Deloitte & Touche LLP to serve as our independent registered public accounting firm for the fiscal year ending December 26, 2021. Deloitte & Touche LLP has served as our independent registered public accounting firm since before our Initial Public Offering and has also provided non-audit services from time to time. Although ratification is not required by our Bylaws or otherwise, our Board of Directors is submitting the selection of Deloitte & Touche LLP to our stockholders for ratification because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate practice. The Audit Committee will consider the outcome of this vote in its decision to appoint an independent registered public accounting firm but is not bound by our stockholders’ vote. Even if the selection of Deloitte & Touche LLP is ratified, the Audit Committee may change the appointment at any time during the year if it determines a change would be in the best interests of the Company and our stockholders. The following table sets forth the fees pertaining to audit services for the fiscal years ended December 27, 2020 and December 29, 2019 and for other services during those fiscal years: | | | | | | | | | | | | 2020 | | | 2019 | | Audit fees (1) | | $ | 846,200 | | | $ | 709,445 | | Audit-related fees (2) | | | 20,000 | | | | 10,000 | | Tax fees (3) | | | 366,759 | | | | 316,159 | | All other fees(4) | | | 1,895 | | | | — | | | | | | | | | | | Total fees | | $ | 1,234,854 | | | $ | 1,035,604 | | | | | | | | | | |

| 1. | Audit fees include fees for audits of executive compensation. In 2016, Aon Hewitt provided consulting services modeling possible equity plan share request sizeour annual financial statements and compliance with institutional shareholder advisor governance guidelines. Aon Hewitt is currently benchmarking executive equity compensation and is also engaged in a reviewinternal controls, reviews of the CEO’s executive employment agreement. Aon Hewitt also provides the Company with consultingrelated quarterly financial statements, and services concerning employee benefit plans. | | | | | | | | | EXECUTIVE AND DIRECTOR COMPENSATION | | | | | | |

2016 Summary Compensation Table

The following table summarizes compensation for the years ending December 25, 2016 and December 27, 2015 earned by our principal executive officer and our two other most highly compensated executive officers. These individualsthat are referred to as our named executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | | Salary | | | Bonus (1) | | | Option Awards (2) | | | Non-Equity

Incentive Plan

Compensation (3) | | | All Other Compensation | | | Total | | Aylwin Lewis | | | 2016 | | | $ | 725,000 | | | $ | 300,000 | | | $ | 1,049,500 | | | $ | 0 | | | $ | 0 | | | $ | 2,074,500 | | Chief Executive Officer | | | 2015 | | | $ | 725,000 | | | $ | 0 | | | $ | 0 | | | $ | 830,647 | | | $ | 0 | | | $ | 1,555,647 | | (Principal Executive Officer) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Michael Coyne | | | 2016 | | | $ | 383,221 | | | $ | 110,000 | | | $ | 200,000 | | | $ | 0 | | | $ | 0 | | | $ | 693,221 | | Chief Financial Officer | | | 2015 | | | $ | 244,162 | | | $ | 0 | | | $ | 1,039,050 | | | $ | 167,845 | | | $ | 0 | | | $ | 1,451,057 | | (Principal Financial Officer) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Matthew Revord | | | 2016 | | | $ | 357,673 | | | $ | 100,000 | | | $ | 180,000 | | | $ | 0 | | | $ | 0 | | | $ | 637,673 | | Chief Legal Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | The amounts shown in the Bonus column represent discretionary cash bonus payments. See“–Non-Equity Incentive Awards–2016 Discretionary Bonus” below. |

(2) | Represents the aggregate grant date fair value of stock option awards. |

| The Company issued stock option awards to Mr. Lewis in 2016 in recognition of his individual performance during the 2015 fiscal year. Mr. Lewis was granted 100,000 options in March of 2016 and 50,000 options in May of 2016, all of which are exercisable without restriction and vest over a period of four years. The Company used the following assumptions for purposes of valuing these March and May option grants, respectively: common stock fair value of $13.73 and $13.27 per share; expected life of options—seven years; volatility—49.49% and 48.91%; risk-free interest rate—1.69% and 1.54%; and dividend yield—0% (for both grants). The Company used the simplified method for determining the expected life of the options. |

| The Company issued 28,145 stock option awards to Mr. Coyne and 25,331 stock option awards to Mr. Revord in March of 2016, which are exercisable without restriction and vest over a period of four years, each in recognition of his respective individual performance during the 2015 fiscal year. The Company used the following assumptions for purposes of valuing these option grants: common stock fair value of $13.73 per share; expected life of options—seven years; volatility—49.49%; risk-free interest rate—1.69%; and dividend yield—0%. The Company used the simplified method for determining the expected life of the options. |

| In May of 2015, Mr. Coyne was granted 150,000 options, which are exercisable without restriction and vest over a period of four years, in connection with his joining Potbelly. In accordance with ASC Topic 718, Compensation—Stock Compensation, fair value of the options was determined using the Black-Scholes-Merton option pricing model and will be amortized over the vesting period. The Company used the following assumptions for purposes of valuing these option grants: common stock fair value of $14.22 per share; expected life of options—seven years; volatility—45.28%; risk-free interest rate—1.89%; and dividend yield—0%. The Company used the simplified method for determining the expected life of the options. |

(3) | Our annual cash incentive awards granted pursuant to our Support Center Annual Incentive Plan are included in theNon-Equity Incentive Plan Compensation Plan column, to the extent such awards are earned. Amounts earned under the plan for performance in fiscal year 2015 were payable in 2016. No annual cash incentive awards were earned under the plan for fiscal 2016 performance. |

Employment Agreements

The following is a summary of the employment agreements the Company has entered into with each of the named executive officers. The summary below does not contain complete descriptions of all provisions of the employment agreements of the named executive officers and is qualified in its entirety by reference to such employment agreements. Mr. Lewis’ employment agreement was filed as an exhibit to our registration statement on formS-1-registration number333-190893. Mr. Coyne’s employment agreement was filed as an exhibit to form8-K filed on April 8, 2015. Mr. Revord’s employment agreement was filed as an exhibit to our form10-K on February 22, 2017. We have also entered into indemnification agreements with our directors and executive officers. See “Related party Transactions–Indemnification Agreements.”

Aylwin Lewis

Mr. Lewis entered into a new Executive Employment Agreement effective as of August 8, 2013 (the “Lewis Agreement”) pursuant to which he will continue to serve as our President and Chief Executive Officer. Under the Lewis Agreement, the term of Mr. Lewis’ employment continues until August 7, 2017. The Lewis Agreement terminates upon death, disability, termination by us with or without cause or resignationnormally provided by the executive with or without good reason. If, at least 30 days prior to August 7, 2017, (1) we do not offer to extend Mr. Lewis’ employment past the last day of the term on terms reasonably consistent with the terms of his current agreement or (2) we offer to extend Mr. Lewis’ employment past the last day of the term but the parties are unable to reach an agreement on the terms of such continuing employment by August 7, 2017, then Mr. Lewis’ termination of employment upon expiration of the term of the Lewis Agreement will be treated as a termination by us without cause subject to Mr. Lewis’ requests during negotiations being reasonable and consistent with the terms of the Lewis Agreement. The Lewis Agreement generally defines “cause” as Mr. Lewis’ (i) intentional misrepresentation of material information, (ii) felony indictment, (iii) commission of an act involving moral turpitude, (iv) material breach or material default of written obligations that remain

| | | | | | | | | | | | | | | EXECUTIVE AND DIRECTOR COMPENSATION |

unremedied for 30 days after notice, (v) fraud, (vi) embezzlement, (vii) failure to comply with our Board of Director’s written lawful direction that remains unremedied for 30 days after notice, or (viii) willful action to harm the Company or its affiliates. The Lewis Agreement generally defines “good reason” as (1) reduction in base salary or target or maximum bonus percentages, (2) material reduction in position, authority, office, responsibilities or duties, (3) material breach of the agreement by us, (4) Mr. Lewis’ failure to bere-elected to the Board of Directors as Chairman while employed as President and Chief Executive Officer, or (5) relocation to a place more than 50 miles from Chicago, in each case without Mr. Lewis’ consent.

A reduction in Mr. Lewis’ rate of base salary or target or maximum bonus which does not exceed the percentage reduction of an across the board salary or bonus reduction for management employees will not be treated as an event of “good reason.”

The Lewis Agreement provides Mr. Lewis with a base salary of $725,000 which shall not be increased. The Lewis Agreement also provides that, under our current bonus program, Mr. Lewis is eligible for an annual target bonus of 100% of his base salary and a maximum (stretch) target of 200% of his base salary. For bonus years beginning 2013, the annual bonus amount and terms and conditions are determined in accordance with incentive plan metrics determined by the compensation committee (but subject to the same targets described in the previous sentence). The compensation committee determined that for fiscal year 2015 the incentive plan metrics applicable to our executive officers were the Company’s total company revenue, adjusted net income, and adjusted EBITDA (where adjusted EBITDA represents net income (loss) before depreciation and amortization expense, interest expense, provision for income taxes andpre-opening costs, adjusted to eliminate the impact of other items, including certainnon-cash as well as certain other items that we do not consider representative of ouron-going operating performance). For fiscal year 2015, the metrics for Mr. Lewis, as an executive officer, were weighted as follows: (a) 40%—total company revenue; (b) 30%—adjusted net income; and (c) 30%—adjusted EBITDA. Beginning with fiscal year 2016, the metrics for Mr. Lewis, as an executive officer, were: (a) 50%—total company revenue; and (b) 50%—adjusted EBITDA. See“—Non-Equity Incentive Awards—2016 Discretionary Bonus” below for a discussion of bonus determinations for fiscal 2016 performance. The Lewis Agreement also provides Mr. Lewis with standard benefits and perquisites, a payment of up to $20,000 for legal feesindependent accountants in connection with statutory and regulatory filings or engagements, including reviews of documents filed with the negotiationSEC.

|

| 2. | Audit-related fees were comprised of the employment agreementfees for services performed in connection with other audit-related services and our filing of registration statements on Form S-8. |

| 3. | Tax fees relate to professional services rendered for tax compliance, tax return review ofand preparation, cost segregation study, and related agreements and a minimum four weeks of vacation.tax advice. |

| 4. | Pursuant to the Lewis Agreement, Mr. Lewis was granted a stock option with a Black-Scholes value of $1,200,000 (227,187 shares) on August 8, 2013(the “Effective Date Grant”). The Effective Date Grant has an exercise price of $10.59. The Lewis Agreement provides that all stock options held by Mr. Lewis prior to the date of the Lewis Agreement (other than the Effective Date Grant) became fully vested on August 8, 2013. The Lewis Agreement also contemplates that Mr. Lewis may be granted equity awards under the Company’s equity incentive plans beginning after August 8, 2015with a target value of $600,000 (subject to increase or decrease as determined by the compensation committee based on performance).

Mr. Lewis is also a partyAll other fees relate to a confidentiality, noncompetition, noninterference and intellectual property agreement, with the noncompetition and noninterference covenants lasting for one year after termination of employment. For information regarding the severance benefits under the Lewis Agreement as well as the treatment of Mr. Lewis’ outstanding equity awards upon a qualifying termination or a corporate transaction/change in control, see “—Potential Payments Upon Termination of Employment or a Corporate Transaction/Change in Control—Aylwin Lewis Employment Agreement.subscription to an accounting research software.

|

Policy on Audit Committee Approval of Audit and Non-Audit Services The Audit Committee’s policy is to approve all audit and permissible non-audit services prior to the engagement of our independent registered public accounting firm to provide such services. The Audit Committee annually approves, pursuant to detailed approval procedures, certain specific categories of permissible non-audit services. Such procedures include the review of (i) a detailed description by our independent registered public accounting firm of the particular services to be provided and the estimated fees for such services and (ii) a regular report to the committee regarding the services provided and the fees paid for such services. The Audit Committee must approve on a project-by-project basis any permissible non-audit services that do not fall within a pre-approved category and any fees for pre-approved permissible non-audit services that exceed the previously approved amounts. In making the determinations about non-audit services, the Audit Committee considers whether the provision of non-audit services is compatible with maintaining the auditor’s independence. All services provided to the Company by Deloitte & Touche LLP in the fiscal years ended December 27, 2020 and December 29, 2019 and related fees were pre-approved by the Audit Committee. Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting and to be available to respond to your questions. They have advised us that they do not presently intend to make a statement at the Annual Meeting, although they will have the opportunity to do so. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. AUDIT COMMITTEE REPORT With regard to the fiscal year ended December 27, 2020, the Audit Committee has (i) reviewed and discussed with management our audited consolidated financial statements as of December 27, 2020 and for the year then ended; (ii) discussed with Deloitte & Touche LLP, the independent auditors, the matters required by the Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301, Communications with Audit Committees; (iii) received the written disclosures and the letter from Deloitte & Touche LLP required by applicable requirements of the PCAOB regarding Deloitte & Touche LLP’s communications with the Audit Committee regarding independence; and (iv) discussed with Deloitte & Touche LLP their independence. Based on the review and discussions described above, the Audit Committee recommended to our Board of Directors of the Company that our audited consolidated financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 27, 2020 for filing with the SEC. Marla Gottschalk, Chairperson Joseph Boehm Adrian Butler PROPOSAL 3 Advisory Vote on a Resolution To Approve Our 2020 Named Executive Officer Compensation We are asking stockholders to approve, on an advisory basis, a non-binding resolution (commonly referred to as a “say-on-pay” resolution) to approve the Company’s 2020 named executive officer compensation as reported in this Proxy Statement. We urge stockholders to read the “Compensation Discussion and Analysis” section of this Proxy Statement, which describes how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as the Summary Compensation Table and other related compensation tables and narrative, which provide detailed information on the compensation of our named executive officers. The Compensation Committee and our Board of Directors believe that the policies and procedures articulated in the “Compensation Discussion and Analysis” are effective in aligning the interests of our officer team with those of stockholders. We have committed to holding say-on-pay votes at each year’s annual meeting. In accordance with Section 14A of the Exchange Act and as a matter of good corporate governance, we are asking stockholders to approve the following advisory resolution at the Annual Meeting: “RESOLVED, that the stockholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed under the “Compensation Discussion and Analysis” and “2020 Compensation Tables” headings of this proxy statement.” This resolution is non-binding on the Board of Directors. Although non-binding, the Board and the Compensation Committee will review and consider the voting results when making future decisions regarding executive compensation. THE BOARD OF DIRECTORS RECOMMENDS AN ADVISORY VOTE “FOR” THE RESOLUTION TO APPROVE OUR 2020 NAMED EXECUTIVE OFFICER COMPENSATION EXECUTIVE OFFICERS In addition to Robert D. Wright, our President and CEO, whose biography is included under the heading “Director Biographies,” our executive officers, their ages as of December 27, 2020, and a brief account of their business experience follows: | | | | |  | | STEVEN CIRULIS Michael Coyne and Matthew Revord

Mr. Coyne entered into an employment agreement with the Company effective as of May 1, 2015. Mr. Revord entered into a new Employment Agreement effective as of July 25, 2013 and amended effective April 22, 2015. Pursuant to the Employment Agreements, Mr. Coyne serves as our Senior Vice President, and Chief Financial Officer and Mr. Revord serves asChief Strategy Officer

Age: 50 | |  | | A Wreck | | | | |

Experience Steven Cirulis has been our Senior Vice President, Chief Financial Officer and Chief Strategy Officer since April 2020. Mr. Cirulis previously served in a strategic planning, finance and analytical consulting role for the Company from December 2019 until his appointment as Chief Financial Officer in April 2020. Prior to that, Mr. Cirulis served as Senior Vice President, Strategic Projects at Panera Bread from April 2017 to July 2018. Prior to his role at Panera Bread, Mr. Cirulis was the Global Vice President, Corporate Strategy, at McDonald’s Corporation from August 2011 to September 2016. Prior to joining McDonald’s, Mr. Cirulis was the Senior Director of Strategy, Business Development and Insights, for Gap Brand at Gap, Inc. from October 2006 to May 2011. | | | | |  | | ADAM NOYES Senior Vice President, General Counsel and Secretary. Mr. Revord has since been appointedChief Operations Officer Age: 51 | |  | | A Wreck | | | | |

Experience Adam Noyes has been our Senior Vice President and Chief of Operations since August 2020. Prior to joining Potbelly, Mr. Noyes held various roles of increasing responsibility at Checkers and Rally’s from April 1991 through December 2019, including serving as Chief Administrative Officer and Executive Vice President from 2016 to 2019. | | | | |  | | ADIYA DIXON Chief Legal Officer. Mr. Coyne’s agreementOfficer and Secretary Age: 42 | |  | | Apple Walnut Salad | | | | |

Experience Adiya Dixon has been our Chief Legal Officer and Secretary since December 2020 and oversees all legal matters of the Company. Prior to joining Potbelly, Ms. Dixon worked as an attorney at AAD Squared, a legal consulting firm, from February 2020 to December 2020. In July 2018, Ms. Dixon founded Yubi Beauty, an e-commerce consumer products company and served as President from its inception through November 2020. Prior to founding Yubi Beauty, Ms. Dixon was employed by Wendy’s International, which owns and operates a chain of quick service restaurants, serving as Director, International Counsel from July 2016 to July 2018 and Director, Corporate Counsel from October 2013 to July 2016. | | | | |  | | JEFFREY DOUGLAS Senior Vice President, Chief Information Officer Age: 49 | |  | | A Wreck with mustard | | | | |

Experience Jeffrey Douglas has been our Senior Vice President and Chief Information Officer since September 2019. Mr. Douglas joined Potbelly from Levy Restaurants, where he served as the Senior Vice President of Information Technology from February 2016 through September 2019. Prior to Levy, Mr. Douglas was the Vice President of Technology for The Options Clearing Corporation from December 2000 to January 2016. COMPENSATION DISCUSSION AND ANALYSIS This Compensation Discussion and Analysis section is intended to provide our stockholders with a clear understanding of our compensation philosophy, objectives and practices; our compensation setting process; our executive compensation program components; and the decisions made with respect to the 2020 compensation of each of our Named Executive Officers (“NEOs”). For 2020, our NEOs were: Robert D. Wright, President and CEO Steven Cirulis, Senior Vice President, Chief Financial Officer and Chief Strategy Officer Adam Noyes, Senior Vice President and Chief of Operations Jeffrey Douglas, Senior Vice President and Chief Information Officer Adiya Dixon, Chief Legal Officer and Secretary Alan Johnson, Former President and CEO Matthew Revord, Former Senior Vice President, Chief Legal Officer, Chief People Officer and Secretary Brandon Rhoten, Former Chief Marketing Officer Robert D. Wright joined us as our President and Chief Executive Officer in July 2020. Steven Cirulis was named Senior Vice President, Chief Financial Officer and Chief Strategy Officer in April 2020, Mr. Noyes was named Senior Vice President and Chief Operations Officer in August 2020 and Ms. Dixon was named Chief Legal Officer and Secretary in December 2020. Executive Summary Performance Overview for 2020 During 2020, we had significant changes in our executive leadership including a change in our President and CEO. In addition, COVID-19 had a significant impact on our business, operations and results during 2020, requiring us to temporarily close the vast majority of our dining rooms and shift to off-premise service, among other impacts. However, even with these significant headwinds and disruptions caused by COVID-19, our management team was able to accomplish the following: Ensured the health and safety of our employees and customers Acted quickly to adjust to the realities of COVID-19 including focusing on creating relaxed convenience, improved access, and new occasions Materially streamlined costs including temporarily reducing executive salaries by 25% Implemented strategy focused on product, enhancing digital presence, menu optimization, operational improvements, brand awareness, and franchising Expanded national partnerships with DoorDash, Grubhub, Uber Eats, and Postmates Our incentive compensation plans worked as intended in 2020. The payouts under those plans were strongly aligned with our financial and stock price performance – demonstrating our commitment to structure an executive compensation program that pays for performance. Compensation Philosophy and Objectives Our compensation philosophy is to pay for performance, rewarding employees when performance targets are met. Merit increases, annual incentive compensation, equity awards, and incremental paid time off are all tied to performance and results. Our compensation programs are designed to attract, retain, motivate, and reward employees. Our pay program is designed to compensate employees commensurate with the scope and influence of the employee’s role and the extent to which an employee contributes to the achievement of key initiatives and financial targets, and demonstrates our values. All of our compensation programs are designed to align and reward actions that we believe contribute to our competitiveness and encourage superior performance. Executive pay is tied to both the Company’s and the individual’s annual performance. Merit increases, annual incentive compensation, equity compensation, when granted, and paid time off are generally awarded in March or April of each year, following completion of the first quarter annual performance review cycle, the annual financial audit and approval from the Compensation Committee. The employment agreements of our named executive officers specify each executive’s annual incentive award target under our current annual incentive program. In addition, at the discretion of the Compensation Committee in the case of our CEO, and at the discretion of our CEO and upon the approval of the Compensation Committee in the case of our other executive officers, there may be an increase or decrease applied to the annual incentive awarded to an executive, including the other named executive officers, in order to account for exceptional circumstances. However, it is anticipated that additional incentives would only be awarded under unusual circumstances to further the objectives of our compensation program. Elements of Executive Compensation The following table provides information regarding the elements of our executive compensation program. | | | | | Element | | Form | | Objectives and Basis | | Base Salary | | Cash | | Attract and retain highly qualified executives. Determined based on the position’s importance within the Company, the executive’s experience, and external market data. | | | | | Annual Incentive Plan | | Cash | | Determined under our company-wide Annual Incentive Plan, which provides for a base salary of $375,000, and Mr. Revord’s agreement provides for a base salary of $310,000. The salaries may be increased from time to time by the compensation committee at the recommendation of our Chief Executive Officer. The employment agreement for Mr. Coyne provides that he is eligible for an annual target bonus of 60% of base salary. The employment agreement for Mr. Revord provides that for bonus years beginningvariable payouts based on or after an IPO, that he shall be eligible for an annual bonus amount to be determined in accordance with incentive plan metrics recommended by the CEO and approved by the compensation committee. For 2016, Mr. Revord was eligible for an annual target bonus of 60% of base salary. For the current bonus year, the annual bonus amount and terms and conditions for each of these executives are determined in accordance with incentive plan metrics recommended by our Chief Executive Officer and approved by the compensation committee. The compensation committee determined that for fiscal year 2016 the incentive plan metrics applicable to our executive officers would be the Company’sfinancial performance against pre-established total company revenue and adjusted EBITDA (where adjusted EBITDA represents net income (loss) before depreciationtargets and amortization expense, interest expense, provision for income taxes andpre-opening costs, adjusted to eliminate the impact of other items, including certainnon-cash as well as certain other items that we do not considerCompensation Committee discretion. | | | | | | | | | EXECUTIVE AND DIRECTOR COMPENSATION | | | | | | | representative of ouron-going operating performance). Further, for Mr. Coyne| Long-Term Incentive | | RSUs and Mr. Revord, as executive officers,PSUs | | Aligns the metrics for fiscal year 2016 were weighted as follows: (a) 50%—total company revenue; and (b) 50%—adjusted EBITDA. See“—Non-Equity Incentive Awards—2016 Discretionary Bonus” below for a discussion of bonus determinations for fiscal 2016 performance. The Employment Agreements also provide the executives with standard benefits and perquisites and a minimum of four weeks of paid time off for Mr. Coyne, and five weeks of paid time off for Mr. Revord. The Employment Agreements contemplate that the executives may be granted equity awards under our equity incentive plans.Each of the Employment Agreements terminates upon death, disability, termination by us with or without cause or resignation by the executive without good reason. The Employment Agreements for Mr. Coyne and Mr. Revord define “cause” and “good reason” in a manner that is comparable to the corresponding terms in the Lewis Agreement (except with respect to election to the Board and nomination as Chairman of the Board). For information regarding the severance benefits under the Employment Agreements and the treatment of Mr. Coyne’s and Mr. Revord’s outstanding equity awards upon a qualifying termination of employment or a corporate transaction/change in control, see “—Potential Payments Upon Termination of Employment or a Corporate Transaction/Change in Control—Employment Agreements.”

Mr. Coyne and Mr. Revord each continue to be parties to a confidentiality, noncompetition, noninterference and intellectual property agreement, with the noncompetition and noninterference covenants lasting for one year after termination of employment.

Equity Awards

Equity awards represent an important componentincentives of our executive compensation. We believeofficers with stockholder interests and rewards the creation of stockholder value; retain executives through long-term incentive awards align the interests of our stockholders and our executives by increasing the proprietary interest of our executives in the Company’s growth and success; advance the Company’s interests by attracting and retaining qualified employees; and motivate our executives to act in the long-term best interests of our stockholders. Long-term incentive awards are issued under our Amended and Restated 2013 Long-Term Incentive Plan (the “2013 Long-Term Incentive Plan”), which replaced the Potbelly Corporation 2004 Incentive Plan (provided that awards under the 2004 Incentive Plan will continue to be subject to the terms of the 2004 Incentive Plan). The 2013 Long-Term Incentive Plan provides for grants of options (including nonqualified stock options and incentive stock options), stock appreciation rights, full value awards, and cash incentive awards. The 2013 Long-Term Incentive Plan is administered by the compensation committee. Under our Insider Trading Policy, our directors and executive officers are prohibited from engaging in short sales or investing in other kinds of hedging transactions or financial instruments that are designed to hedge or offset any decrease in the market value of our securities.

The equity compensation for our named executive officers (other than Mr. Lewis) is determined by the compensation committee upon the recommendation of Mr. Lewis. In 2017, the compensation committee engaged Aon Hewitt to perform a review of executive equity compensation. Once that review is complete, the compensation committee will determine the equity compensation for Mr. Coyne and Mr. Revord in recognition of their respective individual performance during the 2016 fiscal year and make a recommendation to the Board with regard to Mr. Lewis’ equity compensation for his individual performance during the 2016 fiscal year. In March of 2016, Mr. Coyne received a grant of 28,145 stock options and Mr. Revord received a grant of 25,331 stock options, each in recognition of his respective individual performance during the 2015 fiscal year. In May of 2015, Mr. Coyne received a grant of 150,000 stock options in connection with the signing of his employment agreement. The equity compensation for Mr. Lewis is determined by the Board of Directors (other than Mr. Lewis) upon the recommendation of compensation committee. Mr. Lewis received a grant of 100,000 stock options in March of 2016 and a grant of 50,000 stock options in May of 2016 in recognition of his individual performance during the 2015 fiscal year. Under the terms of his employment agreement, Mr. Lewis was not eligible to receive equity compensation as part of the Company’s annual incentive compensation program in March 2014 or March 2015.

Non-Equity Incentive Awards

Support Center Annual Incentive Plan. The Company has established the Support Center Annual Incentive Plan to provide annualnon-equity incentive compensation to executives. Starting with fiscal year 2016, incentives for executive officers were earned based on the following metrics and weighting: (a) 50%—total company revenue; and (b) 50%—adjusted EBITDA (where adjusted EBITDA represents net income (loss) before depreciation and amortization expense, interest expense, provision for income taxes andpre-opening costs, adjusted to eliminate the impact of other items, including certainnon-cash as well as certain other items that we do not consider representative of ouron-going operating performance). This plan sets a threshold, target, and maximum level for each of these

| | | | | | | | vesting. | | | | | | | EXECUTIVE AND DIRECTOR COMPENSATION |

metrics applicable to all executive officers, and the amounts paid are based on the actual figures achieved by the Company. For fiscal year 2016, all executive officers utilized the same metrics and weightings. The targets are set for the year by the compensation committee based on recommendations from Mr. Lewis and Mr. Coyne and are communicated to executives at the beginning of each year. To be eligible for an award under the plan, the executive must receive an annual individual performance appraisal rating of “Contributor” or higher. For fiscal year 2016, the threshold level for these metrics was not achieved. Accordingly, no annual cash incentive awards were paid to the named executive officers under the Support Center Annual Incentive Plan for fiscal 2016 performance.

For fiscal year 2015, incentives for named executive officers were earned based on the achievement ofpre-established targets for performance weighted as follows: (a) 40%—total company revenue; (b) 30%—adjusted net income; and (c) 30%—adjusted EBITDA.

|

|

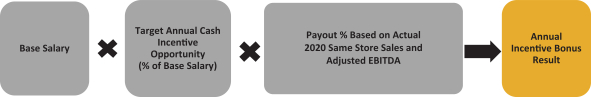

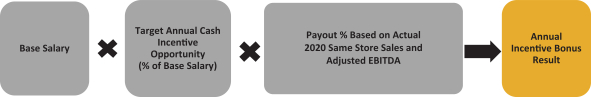

Other Compensation Policies. In addition to the principal compensation elements described above, we provide our executive officers with access to the same benefits we provide all of our full-time employees. Our officers also receive certain limited perquisites and other personal benefits that we believe are reasonable and consistent with our compensation objectives. These perquisites have been identified in the “Summary Compensation Table.” We also provide sign-on bonuses and new-hire equity awards (subject to a time-based vesting period) when the Compensation Committee determines it is necessary and appropriate to advance the Company’s interests, including to attract top-executive talent from other companies. Sign-on bonuses and new hire equity awards are an effective means of offsetting the compensation opportunities executives forfeit when they leave a former employer to join the Company. Our Executive Compensation Process Compensation for our executive officers is comprised of base salary, target value of long-term incentive, and target annual incentive bonus. Executive compensation is designed to be competitive with peer companies and market data, as explained below under “Role of Market Data and Our Peer Group.” Roles and Responsibilities of the Compensation Committee, Compensation Consultant and the CEO in Setting Executive Officer Compensation. Compensation Committee The Compensation Committee reports to the Board. In accordance with its obligations as set forth in its charter, the Compensation Committee retains an independent Consultant and counsel to assist it in evaluating compensation as well as working with the CEO and the Chief Financial Officer to set performance goals. The Compensation Committee determines and approves executive compensation annually, with base salaries, bonus payments (for performance the prior fiscal year), performance goals for long-term incentive grants and annual incentive bonuses approved during the first quarter of the fiscal year. Compensation Consultant In 2020, the Compensation Committee retained the Rewards Solutions practice at Aon plc to provide executive compensation consulting services. Aon attended Compensation Committee meetings when requested and worked with management as necessary to gather and review information required to carry out its obligations. Aon also advised the Compensation Committee on the appropriateness and competitiveness of our compensation programs relative to market practice, our strategy and our internal processes. This process allows the Compensation Committee to consider comprehensive information, including the Company’s performance and each named executive officer’s individual performance during the prior fiscal year, when making final compensation decisions. CEO Mr. Wright, our CEO, and other members of the management team support the Compensation Committee in the executive compensation process and regularly attend portions of committee meetings. Mr. Wright provides the Compensation Committee with his perspective regarding the performance of his executive leadership team, including the other named executive officers. Mr. Wright makes recommendations to the Compensation Committee on the full range of annual executive compensation decisions, except with regard to his own compensation. In accordance with NASDAQ rules, Mr. Wright was not present when his compensation was being discussed and did not vote on executive compensation matters, and neither Mr. Wright nor other members of management attended executive sessions of the Compensation Committee. Role of Market Data and Our Peer Group. As part of the annual executive compensation process, the Compensation Committee reviews compensation levels and practices for executives holding comparable positions at peer group companies and also includes broader compensation survey data. Our market for executive recruiting is generally other restaurant or retail companies. In evaluating the competitiveness of our executive compensation program, we compare our executive’s compensation against the restaurant industry, specifically the limited-service restaurant segment, and national and local competitors to help ensure we are competitive, focusing on items such as equity awards, merit pay, incentive pay and paid time off. The Compensation Committee does not explicitly benchmark our executive officers’ compensation to the peer group, but the peer group data is one of multiple reference points used to evaluate our executive compensation programs. 2020 Peer Group. Our peer group consists of casual dining, fine dining, quick casual and quick service restaurants with similar market capitalization and revenue. The Compensation Committee and independent directors considered the peer group in connection with their fiscal year ended December 27, 2020 executive compensation decisions. The Compensation Committee reviews the composition of the peer group periodically and will make adjustments to the peer group in response to changes in the size of business operations of the Company and of companies in the peer group, companies in the peer group being acquired or taken private, and other companies in the restaurant industry becoming public. The table below lists the companies that were considered for the fiscal year ended December 27, 2020. Casual Dining Ark Restaurants Corp. Chuy’s Holdings, Inc. Denny’s Corporation J. Alexander’s Holdings, Inc. Luby’s Inc. Fine Dining Ruth’s Hospitality Group, Inc. Quick Casual Fiesta Restaurant Group, Inc. Noodles & Company Quick Service El Pollo Loco Holdings, Inc. Del Taco Restaurants, Inc Base Salary The Compensation Committee generally reviews and approves base salaries annually during its meetings in the first quarter with new salaries becoming effective in mid-April. Messrs. Wright, Cirulis and Noyes and Ms. Dixon joined the Company in 2020. Mr. Wright agreed to an initial base salary of $1.00 until July 2021 at which time his base salary will be $650,000 in line with market. Mr. Cirulis’ base salary is $425,000, Mr. Noyes’ base salary is $325,000 (which will increase to $400,000 in September 2021) and Ms. Dixon’s base salary is $275,000. From April 2020 to August 10, 2020, all named executive officers during that period agreed to a temporary 25% reduction in their base salary in an effort to mitigate the impacts of COVID-19. The Company repaid 50% of the reduction in base salary in 2020 and the remaining 50% of the reduction in February 2021. A 3% merit increase was approved by the Board of Directors in early 2020 for all named executive officers at that time but was never implemented as a result of COVID-19. Annual Incentive Plan The Company has established the Support Center Annual Incentive Plan to provide annual cash incentive compensation to executives in its corporate offices (the “Support Center”). The graphic below illustrates the weighting of the metrics and the calculation of the objective component of the 2020 Annual Incentive Plan.

This plan sets a threshold, target, and maximum level for each of these metrics applicable to all executive officers, and the amounts paid are based on the actual results achieved by the Company. The targets are set for the year by the Compensation Committee based on recommendations from the CEO and the Chief Financial Officer and are communicated to executives at the beginning of each year. The threshold, target and maximum criteria and actual fiscal year ended December 27, 2020 results for Same Store Sales and Adjusted EBITDA are as follows. | | | | | | | | | | | | | | | | | | | | | | | | Threshold

(80%) | | | Target

(100%) | | | Maximum

(150%) | | | 2020 Actual

Performance | | | Payout

Percentage | | Same Store Sales | | | 0.8 | % | | | 2.4 | % | | | 4.9 | % | | | (24.7 | %)% | | | 0 | % | Adjusted EBITDA (in millions) | | $ | 20.5 | | | $ | 22.0 | | | $ | 24.0 | | | $ | (32.7 | ) | | | 0 | % |

The chart below sets forth the threshold, target, and maximum percentages of base salary for awards under the Support Center Annual Incentive Plan in 2020, together with the actual bonus levels paid to our NEOs, based on actual Company results. | | | | | | | | | | | | | | | Named Executive Officer | | Threshold | | Target | | Maximum | | Bonus Earned | | | | (%) of

Target | | | ($) | | Robert D. Wright(1) | | — | | — | | — | | | — | | | | — | | Steven Cirulis | | 48% of base salary | | 60% of base salary | | 90% of base salary | | | 0 | % | | $ | 0 | | Adam Noyes(1) | | — | | — | | — | | | — | | | | — | | Jeffrey Douglas | | 48% of base salary | | 60% of base salary | | 90% of base salary | | | 0 | % | | $ | 0 | | Adiya Dixon(1) | | — | | — | | — | | | — | | | | — | | Alan Johnson | | — | | 100% of base salary | | 200% of base salary | | | 0 | % | | $ | 0 | | Matthew Revord | | 48% of base salary | | 60% of base salary | | 90% of base salary | | | 0 | % | | $ | 0 | | Brandon Rhoten | | 48% of base salary | | 60% of base salary | | 90% of base salary | | | 0 | % | | $ | 0 | |

| (1) | Messrs. Wright and Noyes and Ms. Dixon did not participate in the Support Center Annual Incentive Plan in 2016, together2020 as they joined the Company in mid to late 2020. |

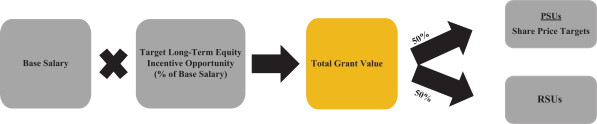

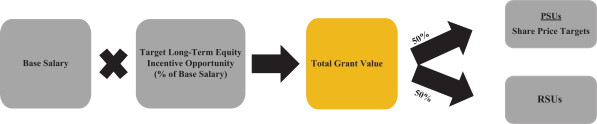

The threshold performance targets were not met in 2020 and no amounts were earned or paid under the 2020 Annual Incentive Plan. 2021 Annual Incentive Plan In February 2021, the Committee revised the Support Center Annual Incentive Plan as follows: The design of the 2021 Annual Incentive Plan will be the same for all support center employees including the named executive officers Lowered the threshold payout from 80% to 50% Adjusted EBITDA will be weighted at 70% and Same Store Sales at 30% of awards granted Long-Term Incentive Awards Long-term incentive awards are currently granted under our 2019 Long-Term Incentive Plan (the “Plan”). The Plan is administered by the Compensation Committee. Equity awards represent an important component of our named executive officer compensation. Beginning with grants in 2019, the equity mix for executive officers changed from 50% stock options and 50% restricted stock units to 50% performance stock units and 50% restricted stock units. The change from stock options to performance stock units served to further align the interests of our stockholders and our executive officers by increasing the proprietary interest of our executive officers in the Company’s growth and success; advance the Company’s interests by attracting and retaining qualified employees over time; and motivate our executives to act in the long-term best interests of our stockholders. The graphic below illustrates the weighting of the metrics and the calculation of the long-term incentive award. Messrs. Wright and Noyes and Ms. Dixon did not receive a long-term incentive award as described above as they were hired during 2020 and Messrs. Wright and Noyes received initial equity grants as described below.

Performance Stock Units Annual performance stock units were granted to our named executive officers on June 24, 2020. Given the impact of COVID-19, unlike 2019, the Compensation Committee determined in June that the performance stock units granted in 2020 vest based on achievement of certain share price achievement of the Company’s common stock and have a performance period from May 15, 2020 to May 15, 2025. The table below outlines the share price achievement levels for the performance period from May 15, 2020 to May 15, 2021. | | | | | | | | | | | | | | | | | | | | 25%

Vesting | | | 50%

Vesting | | | 75%

Vesting | | | 100%

Vesting | | Price Per Share of the Company’s Common Stock | | $ | 3.71 | | | $ | 4.46 | | | $ | 5.20 | | | $ | 5.94 | |

The number of performance stock units granted to our named executive officers in 2020 are reflected in the “Grants of Plan-Based Awards” table on page 41. Certain of the performance stock units granted on June 24, 2020 vested in 2020. See the “Option Exercises and Stock Vested” table for more information. Restricted Stock Units Annual restricted stock units were granted to our named executive officers on June 24, 2020. The restricted stock units vest over three years, beginning on the first anniversary of the grant date. The number of restricted stock units granted to our named executive officers in 2020 are reflected in the “Grants of Plan-Based Awards in 2020” table on page 41. 2021 Long Term Incentive Plan In January 2021, the Committee approved a change to the Long-Term Incentive Plan. For the performance share units issued in 2021, the units will vest based on (1) achieving certain stock price targets or (2) total shareholder return of the Company versus the Russell 3000 T&L Index. Initial Grants to Executives Pursuant to his Employment Agreement (described below), Mr. Wright was granted 300,000 shares of common stock, with half of the shares vesting on the first anniversary of the grant date and the other half vesting at the rate of one twenty-fourth (1/24) on each monthly anniversary of the grant date beginning July 21, 2021. Mr. Wright also received a performance stock unit award with respect to 700,000 shares of the Company’s common stock that will vest based on the achievement of Company stock prices as follows: | | | | | | | | | | | Voting Percentage (Based on

Total Shares Subject to PSU

Award) | | | Pre-Change in Control: Thirty

(30)-day volume weighted

average price (VWAP) of a

Share | | | Change in Control: Price per

Share received by Company

stockholders on closing of

Change in Control Transaction | | | | 40 | % | | $ | 4.00 | | | $ | 3.00 | | | | 40 | % | | $ | 6.00 | | | $ | 5.00 | | | | 20 | % | | $ | 8.00 | | | $ | 7.00 | |

Pursuant to his Employment Agreement (described below), Mr. Cirulis was granted 30,000 restricted stock units on May 18, 2020 and 30,000 restricted stock units on November 10, 2020, and will be granted another 30,000 restricted stock units on April 6, 2021 (provided Mr. Cirulis remains continuously employed by the Company through April 6, 2021). Pursuant to his Employment Agreement (described below), Mr. Noyes was granted $325,000 in restricted stock units, with one-third of the shares vesting on each of the first, second and third anniversaries of the grant date, subject to Mr. Noyes’s continued employment. Other Plans Our named executive officers are eligible to participate in our 401(k) plan. The Company matches 50% of the contributions that our employees, including our named executive officers, make to the 401(k) plan, with a maximum matching contribution of $3,000 per year. The Company matching contribution was suspended in March 2020 through the end of 2020 in an effort to mitigate the negative impact of COVID-19. The Company established in fiscal 2014 a non-qualified deferred compensation plan which allows highly compensated employees to defer a portion of their base salary and variable compensation each plan year. The Company matches 50% of the contributions that our highly-compensated employees, including our named executive officers, make to the deferred compensation plan, with a maximum matching contribution of $3,000 per year. If an employee participates in both the 401(k) plan and the non-qualified deferred compensation plan, the total maximum matching contribution is $3,000 per year. Executive Stock Ownership Guidelines Our stock ownership guidelines were established for executive officers to encourage them to have a long-term equity stake in the Company and to align their interests with stockholders. The Board expects that all executive officers own, or acquire within the later of (i) August of 2022, and (ii) five years of first becoming an executive officer, shares of Potbelly common stock (including restricted shares under Potbelly’s equity-linked incentive plans) having a market value of a multiple of such executive officer’s annual base salary. For the CEO, the multiple is four (4) times annual base salary and for all other executive officers the multiple shall be one and one-half (1.5) times annual base salary. Anti-Hedging Policy Under the Company’s Anti-Hedging Policy, our directors, officers and employees are prohibited from engaging in any kind of hedging transaction that could reduce or limit such person’s holdings, ownership or interest in or to any securities of the Company, including without limitation outstanding stock options, deferred share units, restricted share units, or other compensation awards the value of which are derived from, referenced to or based on the value or market price of securities of the Company. Prohibited transactions include the purchase by a director, officer or employee of financial instruments, including, without limitation, prepaid variable forward contracts, instruments for short sale or purchase or sale of call or put options, equity swaps, collars, or units of exchangeable funds, that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Company. Clawbacks and Forfeiture Provisions On October 2019, the Company adopted an executive compensation recoupment policy that provides for the potential recoupment of any incentive-based award paid to all current and former executive officers. In the event that the Company is required to restate its financial results due to material noncompliance with any financial reporting requirement as a result of any gross negligence, intentional misconduct, theft, embezzlement, fraud or other serious misconduct by an executive officer, the result of which is that any performance-based compensation received by such executive officer during the three-year period preceding the publication of the restated financial statement would have been lower had it been calculated based on such restated results, the Compensation Committee may seek to recover the excess of the incentive compensation paid to the executive based on the erroneous data. Employment Agreements The following is a summary of the employment agreements the Company has entered into with each of the named executive officers. CEO Employment Agreement The Company entered into an employment agreement with Mr. Wright (the “Wright Agreement”) with a term commencing on July 20, 2020 and ending on July 20, 2023 (unless terminated earlier in accordance with its terms). Under the Wright Agreement, Mr. Wright will be paid an initial base salary of $1.00 for the period commencing on July 20, 2020 through June 30, 2021, which increases to an annual base salary of $650,000. Mr. Wright will receive a cash sign-on bonus of $400,000 payable on July 1, 2021 subject to Mr. Wright’s continued employment and subject to earlier vesting in the event of his termination for certain reasons after December 31, 2020. The Wright Agreement also provides, among other things, that: (i) Mr. Wright is eligible to receive an annual cash incentive for each calendar year beginning with calendar year 2021, based on satisfaction of performance conditions as determined in the sole discretion of the Board of Directors of (A) sixty percent (60%) of the his base salary at the threshold level of performance, (B) one hundred and fifteen percent (115%) of his base salary at the target level of performance, and (C) two hundred percent (200%) of his base salary at the maximum level of performance. Mr. Wright is also entitled to receive severance upon his agreement to a general release of claims in favor of the Company following termination of employment as described in more detail below under “Potential Payments Upon Termination of Employment or a Corporate Transaction/Change in Control.” Mr. Wright will also be eligible to participate in all customary employee benefit plans or programs of the Company generally made available to the Company’s senior executive officers, and the Company will reimburse all reasonable business expenses incurred by Mr. Wright in performing services to the Company. Other Current NEO Employment Agreements Cirulis Employment Agreement. On April 6, 2020, the Company entered into an employment agreement with Mr. Cirulis (the “Cirulis Agreement”). Under the Cirulis Agreement, Mr. Cirulis will be paid an annual base salary of $425,000, although as was the case with all senior management at the time, his base salary was temporarily reduced by 25% until August 10, 2020 (which reductions have been repaid). The Cirulis Agreement also provides, among other things, that: (i) Mr. Cirulis is eligible to receive an annual cash incentive at a target rate of 60% of his base salary based on the attainment of mutually agreed upon performance goals; (ii) Mr. Cirulis is eligible for annual equity grants as determined by the Compensation Committee; (iii) the Company shall reimburse all reasonable business expenses incurred by Mr. Cirulis in performing services to the Company; and (iv) Mr. Cirulis will be entitled to severance and change of control benefits under certain circumstances following termination of employment. Mr. Cirulis will also be eligible to participate in all customary employee benefit plans or programs of the Company generally made available to the Company’s senior executive officers. Noyes Employment Agreement. On August 28, 2020, the Company entered into an employment agreement with Mr. Noyes (the “Noyes Agreement”). Under the Noyes Agreement, Mr. Noyes will be paid an annual base salary of $325,000, which will increase to $400,000 on September 1, 2021. The Noyes Agreement also provides, among other things, that: (i) Mr. Noyes is eligible to receive an annual cash incentive at a target rate of 60% of his base salary based on the attainment of mutually agreed upon performance goals; (ii) beginning in calendar year 2021, Mr. Noyes is eligible for annual equity grants as determined by the Compensation Committee; (iii) the Company shall reimburse all reasonable business expenses incurred by Mr. Noyes in performing services to the Company; and (iv) Mr. Noyes will be entitled to severance and change of control benefits under certain circumstances following termination of employment. Mr. Noyes will also be eligible to participate in all customary employee benefit plans or programs of the Company generally made available to the Company’s senior executive officers. Douglas Employment Agreement. On September 3, 2019, the Company entered into an employment agreement with Mr. Douglas (the “Douglas Agreement”). Under the Douglas Agreement, Mr. Douglas will be paid an annual base salary of $300,000. The Douglas Agreement also provides, among other things, that: (i) Mr. Douglas is eligible to receive an annual cash incentive at a target rate of 60% of his base salary based on the attainment of mutually agreed upon performance goals; (ii) Mr. Douglas is eligible for annual equity grants as determined by the Compensation Committee; (iii) the Company shall reimburse all reasonable business expenses incurred by Mr. Douglas in performing services to the Company; and (iv) Mr. Douglas will be entitled to severance and change of control benefits under certain circumstances following termination of employment. Mr. Douglas will also be eligible to participate in all customary employee benefit plans or programs of the Company generally made available to the Company’s senior executive officers. Dixon Employment Agreement. On November 11, 2020, the Company entered into an employment agreement with Ms. Dixon (the “Dixon Agreement”). Under the Dixon Agreement, Ms. Dixon will be paid an annual base salary of $275,000. The Dixon Agreement also provides, among other things, that: (i) beginning in calendar year 2021, Ms. Dixon is eligible to receive an annual cash incentive at a target rate of 60% of her base salary based on the attainment of mutually agreed upon performance goals; (ii) beginning in calendar year 2021, Ms. Dixon is eligible for annual equity grants as determined by the Compensation Committee; and (iii) Ms. Dixon will be entitled to severance and change of control benefits under certain circumstances following termination of employment. Also beginning in calendar year 2021, Ms. Dixon will be eligible to participate in all customary employee benefit plans or programs of the Company generally made available to the Company’s senior executive officers. COMPENSATION COMMITTEE REPORT The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis included in this Proxy Statement with management. Based on such review, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement for filing with the SEC. Benjamin Rosenzweig, Chairperson Marla Gottschalk David Head David Near EXECUTIVE COMPENSATION Summary Compensation Table The following table summarizes compensation for the years ended December 27, 2020, December 29, 2019 and December 30, 2018 earned by our named executive officers which for the year ended December 27, 2020 includes (1) the two individuals who served as our principal executive officer for any part of 2020, (2) our principal financial officer, (3) our next three most highly compensated executive officers who were serving as executive officers as of December 27, 2020 and (4) two additional individuals who would have been a named executive officer had they been an executive officer as of December 27, 2020. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | | Salary (7) | | | Bonus (8) | | | Stock

Awards (9) | | | Option

Awards | | | Non-Equity

Incentive Plan

Compensation | | | All

Other

Compensation (10) | | | Total | | Robert D. Wright | | | 2020 | | | $ | 1 | | | $ | — | | | $ | 2,206,000 | | | $ | — | | | $ | — | | | $ | 7,325 | | | $ | 2,213,326 | | President and Chief Executive Officer (1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Steven Cirulis | | | 2020 | | | $ | 293,618 | | | $ | 100,000 | | | $ | 693,301 | | | $ | — | | | $ | — | | | $ | 2,517 | | | $ | 1,089,436 | | Senior Vice President, Chief Financial Officer and Chief Strategy Officer (2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Adam Noyes | | | 2020 | | | $ | 107,500 | | | $ | 100,000 | | | $ | 324,998 | | | $ | — | | | $ | — | | | $ | 3,467 | | | $ | 535,965 | | Senior Vice President and Chief Operations Officer (3) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Jeffrey Douglas | | | 2020 | | | $ | 298,125 | | | $ | — | | | $ | 209,999 | | | $ | — | | | $ | — | | | $ | 6,052 | | | $ | 514,176 | | Senior Vice President and Chief Information Officer | | | 2019 | | | $ | — | | | $ | — | | | $ | 350,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 350,000 | | | | | | | | | | | Adiya Dixon | | | 2020 | | | $ | 31,761 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 108 | | | $ | 31,869 | | Chief Legal Officer and Secretary (4) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Alan Johnson | | | 2020 | | | $ | 448,050 | | | $ | — | | | $ | 999,999 | | | $ | — | | | $ | — | | | $ | 351,794 | | | $ | 1,799,843 | | Former President and CEO (1) | | | 2019 | | | $ | 746,750 | | | $ | — | | | $ | 1,250,000 | | | $ | — | | | $ | — | | | $ | 18,519 | | | $ | 2,015,269 | | | | | 2018 | | | $ | 725,000 | | | $ | 543,750 | | | $ | — | | | $ | — | | | $ | — | | | $ | 399,114 | | | $ | 1,667,854 | | | | | | | | | | | Matthew Revord | | | 2020 | | | $ | 406,401 | | | $ | — | | | $ | 498,478 | | | $ | — | | | $ | — | | | $ | 50,026 | | | $ | 954,905 | | Former Senior Vice | | | 2019 | | | $ | 403,300 | | | $ | 416,250 | | | $ | 481,000 | | | $ | — | | | $ | — | | | $ | 3,000 | | | $ | 1,303,550 | | President, Chief Legal Officer, Chief People Officer and Secretary (5) | | | 2018 | | | $ | 370,000 | | | $ | 205,500 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 575,500 | | | | | | | | | | | Brandon Rhoten | | | 2020 | | | $ | 426,995 | | | $ | — | | | $ | 525,300 | | | $ | — | | | $ | — | | | $ | — | | | $ | 990,626 | | Former Chief Marketing Officer (6) | | | 2019 | | | $ | 425,000 | | | $ | — | | | $ | 281,972 | | | $ | — | | | $ | — | | | $ | 217 | | | $ | 707,189 | | | | | 2018 | | | $ | 228,846 | | | $ | 36,678 | | | $ | 250,000 | | | $ | 250,000 | | | $ | — | | | $ | 21,125 | | | $ | 786,649 | |

| (1) | Mr. Wright joined the Company as President and Chief Executive Officer in July 2020 at which time Mr. Johnson’s employment with the percentage of actual or weighted salary received, based on actual Company results:terminated. | | | | | | | | | | | | | | | | | Named Executive Officer | | Threshold | | | Target | | | Maximum | | | Percent of Actual or

Weighted Average

Salary Received | | Aylwin Lewis

| | | — | | | | 100% of base salary | | | | 200% of base salary | | | | 0% of salary | | Michael Coyne

| | | 48% of base salary | | | | 60% of base salary | | | | 90% of base salary | | | | 0% of salary | | Matthew Revord

| | | 48% of base salary | | | | 60% of base salary | | | | 90% of base salary | | | | 0% of salary | |

| (2) | 2016 Discretionary Bonus. Under certain circumstances, the compensation committee may deem it appropriate to award discretionary bonuses to certain named executive officers. Following the compensation committee’s conclusion that the threshold metrics under the Support Center Incentive Plan were not achieved for fiscal year 2016, the compensation committee determined it was appropriate to grant a discretionary bonus to the named executive officers in recognition of their numerous contributions toMr. Cirulis joined the Company as Senior Vice President, Chief Financial Officer and their respective significant accomplishmentsChief Strategy Officer in fiscal year 2016. For example,April 2020.

|

| (3) | Mr. Noyes joined the Company as Senior Vice President and Chief Operations Officer in assessing Mr. Lewis’ performance and determiningAugust 2020. |